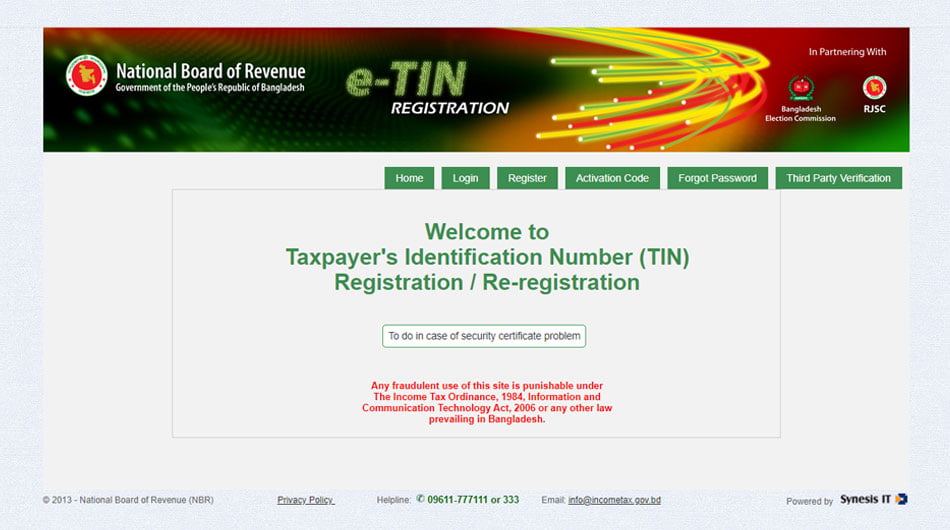

All individual taxpayers and business entities are required to obtain an e-TIN (Tax Identification Number) in Bangladesh to file income tax returns and to avail other services. E-TIN is issued by the National Board of Revenue (NBR) and the easiest way is to obtain this online from https://secure.incometax.gov.bd/TINHome. Below is the process of obtaining an e-TIN in Bangladesh:

Required Information and Documents

| # | Requirements |

| 1 | A valid mobile number (not used before to obtain) |

| 2 | A valid e-mail address (not used before to obtain) |

| 3 | Certificate of Incorporation (for company/ firm), NID for individuals. |

| 4 | Name of authorized person (for company/ firm) |

Process Steps

| # | Descriptions |

| Step 1 | Applicant visits the following website “http://secure.incometax.gov.bd/TINHome” |

| Step 2 | At first, applicant needs to click on “Register” option as appeared to create user and needs to fill in the required information fields |

| Step 3 | System sends an “Activation code” to the applicant’s phone number to register the user ID |

| Step 4 | Once the process completed, system would confirm the completion of user registration |

| Step 5 | Applicant needs to log in using the credential of user ID |

| Step 6 | After logged in, applicant needs to click “TIN Application” option as appeared in left side and needs to fill all required information fields and submit the application |

| Step 7 | After successful submission, applicant gets the certificate on page and also e-mailed through the system immediately or within 15 to 20 minutes |

Processing Time

Instant provided all information is provided accurately.

Government Fees

No fees required

ACE Advisory is one of the leading professional service firms in Bangladesh and can assist clients in obtain an e-TIN.

Written By – Anik Das & Iztihad ____

Date – 5 January 2022