Entitlement

As per VAT Act 2012, VAT/BIN registration is mandatory for entities if annual turnover is above Tk. 30 million and entities shall be eligible for enlistment if annual turnover is above Tk. 5 million up to 30 million. However, for some specific supplies and services VAT registration is mandatory regardless of turnover amounts. Voluntary registration is also available for businesses if required.

Required Information and Documents

| # | Documents |

| 1 | TIN certificate |

| 2 | NID/Passport copy of owner/shareholders |

| 3 | Bank solvency certificate/Latest bank statements |

| 4 | Trade license |

| 5 | Certificate of Incorporation |

| 6 | Import registration certificate and (for import activity) |

| 7 | Export registration certificate (for export activity) |

| 8 | Layout Plan equipment (for manufacturing activity) |

| 9 | List of Machinery & equipment (for manufacturing activity) |

| 10 | Old BIN (if any) |

| 11 | BIDA registration (for branch office) |

| 12 | Name, mobile number and e-mail of authorized person |

Process Steps

| # | Descriptions |

| Step 1 | Applicant visits the following website “vat.gov.bd” |

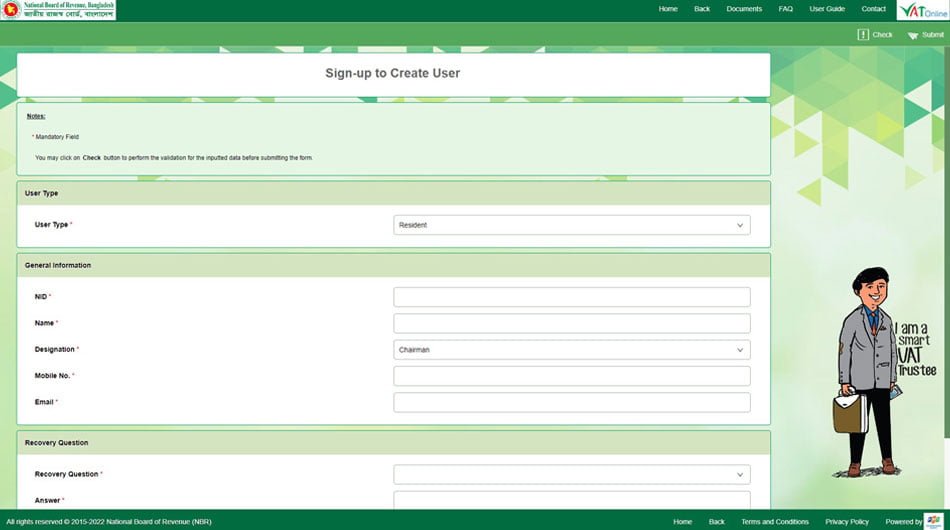

| Step 2 | At first, applicant needs to click on “Sign-up” option as appeared to create user and needs to fill in the required information fields |

| Step 3 | After submitting the required information, system sends an “Activation code” to the applicant’s phone number to register the user ID |

| Step 4 | Once the process completed, system sends an e-mail contains user ID and one-time password |

| Step 5 | Applicant needs to log in using the credential of VAT online ID |

| Step 6 | After logged in, applicant needs to go “Form” option and need to click at “Add form” and select “Mushak – 2.1 VAT/Turnover Tax Registration Form” |

| Step 7 | Applicant fill all required information fields and submit the application with all required supporting documents |

| Step 8 | After successful submission, NBR officials verify and inspect the documents |

| Step 9 | Applicant gets the certificate printed or e-mailed through the system |

Processing Time

7-15 days (estimated)

Government Fees

No fees required

ACE Advisory is one of the leading professional service firms in Bangladesh and can assist clients to obtain VAT/BIN registrations.

Written by – Anik Das & Iztihad

Date – 28 March 2022