Tax Implications

- Corporate Income Tax

-

27.5%

- Capital Gains Tax for companies. (For individuals, this is taxed at personal income tax rate)

-

15%

- VAT

-

15%

*Refers to general tax rates. Actual rates may vary.

Basis

- Resident entities are taxed on their worldwide business income.

- Non-residents are taxed only on Bangladesh-source income.

- Income arising directly or indirectly through or from a Permanent Establishment (PE) in Bangladesh will be deemed to accrue or arise in Bangladesh.

Permanent Establishment

The definition of a “Permanent Establishment” in relation to income from business or profession includes:

- a place of management

- a branch

- an agency

- an office

- a warehouse

- a factory

- a workshop

- a mine, oil or gas well, quarry or any other place of exploration, exploitation or extraction of natural resources

- a farm or plantation

- a building site, a construction, assembly or installation project or supervisory activities in connection therewith

- the furnishing of services, including consultancy services, by a person through employees or other personnel engaged by the person for such purpose, if activities of that nature continue (for the same or a connected project) in Bangladesh; and

- any associated entity or person (hereinafter referred to as “Person A”) that is commercially dependent on a non-resident person where the associated entity or Person A carries out any activity in Bangladesh in connection with any sale made in Bangladesh by the non-resident person

Income Year

Income year is as follows:

- Newly set up business –date of incorporation to the following 30 June.

- Banks, insurance or financial institutions –from 1 January to 31 December.

- Other companies –1 July to 30 June

Provided that the authorities may allow a different financial year for a company which is a Subsidiary/Branch Office/Liaison Office of a company incorporated outside Bangladesh if such company is required to follow a different financial year for the purpose of consolidation of its accounts with its parent

Rates of Corporate Tax

The applicable rates of tax for companies are as follows:

| Type | Rate | Applicable tax rate if fails to meet the condition |

|---|---|---|

| Publicly traded companies i.e. companies listed with any stock exchanges in Bangladesh other than banks, insurance and other financial institutions, merchant banks, mobile phone operating companies and cigarette manufacturing companies. If such a company transfers more than 10% shares through IPO. |

20% | 22.50% |

| Publicly traded companies i.e. companies listed with any stock exchanges in Bangladesh other than banks, insurance and other financial institutions, merchant banks, mobile phone operating companies and cigarette manufacturing companies. If such a company transfers equal to 10% or less than 10% shares through IPO |

22.50% | 25% |

| Non-listed companies | 27.50% | 30% |

| One-person companies | 22.50% | 25% |

| Banks, insurance, mobile financial services (MFS) and other financial institutions (except merchant banks) if not publicly listed. | 40% | Condition not applicable |

| Banks, insurance, mobile financial services (MFS) and other financial institutions (except merchant banks) if publicly listed. | 40% | Condition not applicable |

| Merchant banks | 37.50% | Condition not applicable |

| Cigarette, bidi, zarda, gul and all tobacco manufacturers (companies, firms and individuals) irrespective of listing | 45% | Condition not applicable |

| Mobile phone operating companies if not publicly listed as below. | 45% | Condition not applicable |

| Listed Mobile phone operating companies (subject to certain conditions) | 40% | Condition not applicable |

| Jute Industries (up to 30 June 2023) | 10% | Condition not applicable |

| Knit wear and woven garments manufacturers and exporters | 12% | Condition not applicable |

| Knit wear and woven garments manufacturers and exporters with “green building certification” | 10% | Condition not applicable |

| Private university/medical college/dental college/engineering college/college involved in IT education | 15% | Condition not applicable |

| Co-operative societies registered under Co-operative Societies Act, 2001 | 15% | Condition not applicable |

| Dividend Income | 20% | Condition not applicable |

| Association of persons | 27.50% | 30% |

| Artificial juridical person and other taxable entity | 27.50% | 30% |

Income Tax Return Filing

All companies/Branch & Liaison Offices in Bangladesh are required to obtain an e-TIN from the authorities. Companies are required to file their tax returns on the later date of the following:

- 15th day of the seventh month following the end of the income year

- Following 15 September

Such tax returns must be accompanied by:

- Audited financial statements prepared in accordance with International Financial Reporting Standards.

- Computation of total income with supporting schedules

- Other supporting documents

Withholding Income Tax Requirements

Bangladesh has extensive withholding tax requirements on all local payments. Please contact us for exhaustive listing of such requirements. The withholding tax requirements from payments to non-residents (unless reduced under a Double Taxation Avoidance Agreement) are as follows

| Nature of Payment | Rate |

|---|---|

| Advisory or consultancy service | 20% |

| Pre-shipment inspection service | 20% |

| Professional service, technical services, technical know-how or technical assistance | 20% |

| Architecture, interior design or landscape design, fashion design or process design | 20% |

| Certification, rating etc. | 20% |

| Charge or rent for satellite, airtime or frequency, rent for channel broadcast | 20% |

| Legal service | 20% |

| Management service including event management | 20% |

| Royalty, license fee or payments related to intangibles | 20% |

| Interest | 20% |

| Advertisement broadcasting | 20% |

| Advertisement making or digital marketing | 15% |

| Air transport or water transport except in certain circumstances. | 7.5% |

| Contractor or sub-contractor of manufacturing, process or conversion, civil work, construction, engineering or works of similar nature. | 7.5% |

| Supplier | 7.5% |

| Capital gain | 15% |

| Insurance premium | 10% |

| Rental of machinery, equipment etc. | 15% |

Dividend:

|

20% 30% |

| Artist, singer or player | 30% |

| Salary or remuneration | 30% |

| Exploration or drilling in petroleum operations | 5.25% |

| Survey for coal, oil or gas exploration | 5.25% |

| Any service for making connectivity between oil or gas field and its export point | 5.25% |

| Any payments against any services not mentioned above | 20% |

| Fees, etc. of surveyors of general insurance company | 20% |

Dividend:

|

20% 10% |

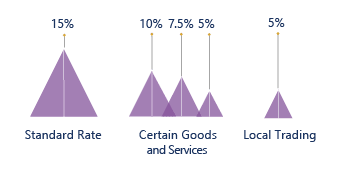

Value Added Tax (VAT)

VAT is levied on the supply of goods and the provisions of services, and on the import of goods and services. Supplies of goods and services without consideration are valued at their fair market price.

- The standard rate of VAT is 15% with certain exemptions for certain services.

- Reduced rates of 5%, 7.5% and 10% apply to certain goods and services.

- Local trader including commercial importers pay 5% VAT.

- Exports are zero rated for VAT.

Registration

- VAT registration is mandatory for suppliers having a turnover of more than BDT 30 million.

- Suppliers with turnover between BDT 5 million and BDT 30 million may opt for voluntary registration or pay turnover tax at 4%.

- Suppliers with turnover of less than BDT 5 million are not required to register.

- VAT registration is mandatory for:

Importers

Importers Exporters

Exporters All withholding entities

All withholding entities Suppliers dealing in goods subject to supplementary duty

Suppliers dealing in goods subject to supplementary duty

Branch, liaison or project

Branch, liaison or project

office of foreign companies VAT agent

VAT agent

- Centralized registration process can be applied where supplies of similar goods and services are made from multiple business locations.

- Companies with no physical presence in Bangladesh but subject to VAT-able supplies need to appoint a VAT agent.

Filing and Payment

- VAT returns must be filed within 15 calendar days from the end of the month.

- VAT deducted at source has to be deposited to government treasury within seven (7) days from the end of VAT period (the month of deduction)

- Entities exceeding turnover limit of BDT 50 million are required to use NBR designated VAT software(s).

- Registered limited companies need to submit Financial Statements to NBR within 6 (six) months from the end of the income year. Upon application, commissioner may further extend the period of submission up to additional 6 (six) months.

Double Taxation Avoidance Agreements

other countries for avoiding double taxation. This treaty includes provision for relief from tax on

income such as dividend, royalty, technical fees, business profits, etc. Bangladesh currently holds

agreements on avoidance of double taxation with 34 countries:

Transfer Pricing

OECD type transfer pricing provisions apply. The definition of “associated enterprise” extends beyond a shareholding or management relationship, as it includes some deeming clauses.

Every person/company who has entered into an international transaction shall furnish a statement of international transactions in the prescribed form along with their annual income tax return.

A taxpayer that engages in cross-border transactions exceeding BDT 30 million is required to maintain documentation and to provide a certificate (in a prescribed format) from a chartered  accountant that sets out the details of related party transactions, as well as the methods used to determine an arm’s length price, provided a notice for filing the certificate is received from the tax authorities.

accountant that sets out the details of related party transactions, as well as the methods used to determine an arm’s length price, provided a notice for filing the certificate is received from the tax authorities.